Is It Better to Claim Yourself on Taxes

You really dont have much choice. If the IRS refunded you last year for all of the federal income tax that was withheld and if you expect that to happen again this year you can claim exemption from withholding.

For example if you owe 6000 in taxes and claim a credit worth 1000 your bill drops to 5000.

. With TurboTax Its Fast And Easy To Get Your Taxes Done Right. If you do youll have to address this out of pocket and if you didnt save up enough you may have to wait to take care of your tax bill. You would most likely have received a lump sum at the end of the tax season.

Tax code makes it clear who can be claimed as a dependent but its a little less precise about when a dependent can voluntarily separate themselves from a taxpayer whos able to claim them. Sadly as the Hitchhikers Guides Prosser would say Well no not as such Turns out claiming yourself as independent when applying for federal aid is much much harder. Understandably many parents get in the habit of claiming their children as dependents on their federal tax returns.

Through some digging I found. One important rule to know is whether or not you can claim an exemption for yourself on your federal taxes. However incorrectly claiming yourself could cost you in tax penalties.

With every paycheck or in one lump sum during tax season. Claiming 1 on Your Taxes. You cannot claim exemption from withholding if either one of the following is true.

If you were single and someone claimed you as a dependent then claiming zero on a W-4 would make sense. Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks so you get more money now with a smaller refund. This is essentially a deduction that reduces the amount of your income that is subject to federal income tax.

But coordinate with your parents to let them know that they can no longer claim you because you are claiming yourself. I found this out today as I was going through the pleasant process of filling the application out. You can be claimed as a dependent by your fiancé under the qualifying relative rules if all these apply.

Sounds like you qualify to claim yourself as an independent. However you must determine if you are eligible to take the personal exemption. Get a Bigger Tax Refund.

There are some exceptions. For example if you have 1 job you can either claim 0 or 1. Claiming yourself can save you some money on your taxes by reducing your taxable income.

Each allowance you claim lowers the income subject to withholding. It is better to claim 1 if you are good with your money and 0 if you arent. Also on your return this year you check that you cannot be claimed by anyone else.

What it comes down to is the type and amount of income you earn and whether your parents or someone else can claim you as a dependent or not. Is it better to claim 1 or 0. March 17 2021.

Your income is less than. But dependents cant claim someone else as a dependent. This is because if you claim 1 youll get taxed less but you may have to pay more taxes later.

The more you claim the larger your take-home pay. Get Your Max Refund Today. You generally may do so as long as your child is either under age 19 nonstudents or under age 24 students.

If you paid for more than half with your earned income you supported yourself. If youd rather get more money with each paycheck instead of having to wait for your refund claiming 1 on your taxes is typically a better option. Claim Your Credits A tax credit reduces the amount of tax you owe to the IRS on a dollar-for-dollar basis.

The difference between claiming 1 and 0 on your taxes will determine when you will be getting the most money. Claiming an Exemption From Withholding. If you were struggling to save money for your taxes claiming zero was also a good idea.

If you and your spouse file joint tax returns and one of you can be claimed as a dependent neither of you can claim any dependents. You lived with your fiancé the entire year. Another person can claim you as a dependent.

Claiming Yourself on Taxes. Whether or not its legal to claim yourself on federal taxes has nothing to do with your age. Through 2017 probably the most common benefit to not having someone be able to claim you as a dependent is the personal exemption.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. But the fact that you are under 18 years of age makes it more likely that youre someones dependent. You can claim yourself as a dependent on your parents return if you are married and dont owe any taxes.

When it comes to tax time all the different rules can make your head spin. If you prefer to receive your money with every. Claiming Yourself on Taxes Through 2017 probably the most common benefit to not having someone be able to claim you as a dependent is the personal exemption.

If a parent or someone else paid for more than half of your living expenses you did not support yourself. However this also means you might receive a hefty bill at tax time if you arent careful. You can claim yourself as an independent on your FAFSA too right.

This amount is zero in tax years 2018 through 2025. But depending on your personal situation claiming one allowance doesnt automatically mean you will owe taxes you could even receive a refund in addition to taking home more money every pay period. Consider all your living expenses and what you contributed.

You might be able to claim yourself as an independent on taxes. You are not your own dependent but you can potentially claim a personal exemption. For example if you have a dependent who receives more than 50 of your support from your parents you should file your own taxes.

If you qualify as a dependent of someone else you cannot claim your own exemption even if that person does not claim you. But there is a reason to not claim your child as a dependent and it has everything to do with higher education. If you used unearned income or student loans to pay for most of your expenses you did not support.

Think of a personal exemption as claiming yourself. As long as you qualify you yourself can be claimed as a dependent even if you paid your own taxes and filed a tax return.

Taxes How Many Allowances Should You Claim Financial Motivation Tax Help Income Tax

6 Tips For Filing Taxes With Multiple Jobs Filing Taxes Extra Jobs Job

Deducting Your Home Office Expenses For All The Visual Learners Out There This Board Is For You We Ve Online Taxes Home Office Expenses File Taxes Online

The Most Common Tax Mistakes Infographic Tax Mistakes Income Tax Income Tax Return

Monday Moneyvator Give Yourself A Bumper 2016 Tax Return With Images Tax Return Personal Finance Blogs Tax Prep

Tax Resolution Company Brochure Company Brochure Brochure Graphic Design

Tax Tips For A Bigger Refund Tax Refund Personal Finance Budget Finance Investing

How To Claim A Deduction For Charitable Giving Tax Deadline Remote Jobs First Home Buyer

Understanding Your Own Tax Return Tax Forms Income Tax Return Income Tax

Tax Deductions That An Individual Can Claim Taxdeductions Smarttaxservices Tax Deductions Tax Services Deduction

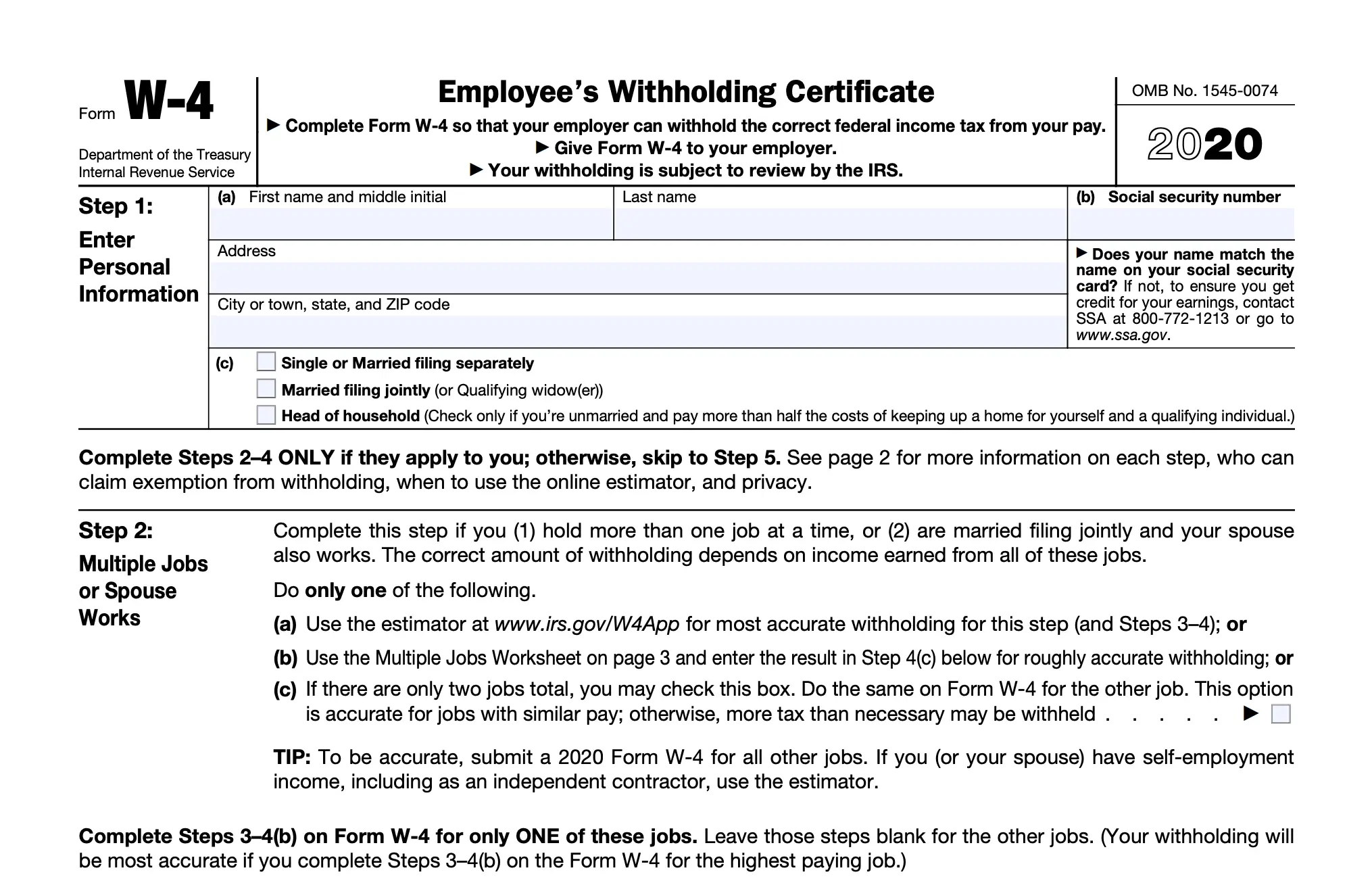

Should I Claim 1 Or 0 On My W4 What S Best For Your Tax Allowances

How Many Tax Allowances Should I Claim Community Tax

Can I Claim Them As A Dependent For All The Visual Learners Out There This Board Is For You We Ve Condensed C Filing Taxes File Taxes Online Online Taxes

5 Must Know Tax Tips The Happier Homemaker Tax Checklist Tax Time Filing Taxes

Tax Deduction Checklist For Creatives Tax Deductions Creative Business Document Sorting

The 1 Most Overlooked Tax Deduction Could Save You 1 000 Tax Deductions Deduction Tax Credits

5 Important Questions To Ask Before You Decide To Do Your Own Taxes Grand Ascent Tax Help Tax Tax Write Offs

How To File Your Taxes Early Before The Rush Filing Taxes Tax Refund Tax Time

Comments

Post a Comment